|

PARAMOUNT SENDS LETTER TO WARNER BROS. DISCOVERY SHAREHOLDERS

Reiterates why Paramount's offer will deliver WBD shareholders with superior value and a faster, more certain path to completion than the Netflix transaction

Encourages shareholders to tender their shares today to register their view with the WBD Board of Directors that they prefer the superior Paramount transaction

(1) Based on unaffected price as of September 10, 2025 (prior to WSJ leak).

LOS ANGELES and NEW YORK, Dec. 10, 2025 -- Paramount, a Skydance Corporation (NASDAQ: PSKY) ("Paramount"), today sent a letter to the shareholders of Warner Bros. Discovery, Inc. (NASDAQ: WBD) ("WBD"). The letter clearly sets out why Paramount's $30.00 per share all-cash offer to acquire all of WBD is superior to WBD's transaction with Netflix (NASDAQ: NFLX).

Full text of the letter follows below.

Dear Warner Bros. Discovery Shareholder:

Paramount began pursuing Warner Bros. Discovery ("WBD") because we, along with our partner RedBird Capital, believe we are the best stewards not only to build long-term value for the asset but also delight audiences and help cultivate a more vibrant creative community. We funded, founded and then merged Skydance with Paramount and know the sacrifices and investment it takes to capitalize and grow a media business. I am passionate and dedicated to this pursuit, committed to putting my own money in, and that is why I am writing to you today.

Over the past 12 weeks, Paramount presented six proposals to the WBD Board of Directors and management to acquire all of WBD. On Monday, we launched a $30.00 per share all-cash tender offer to present our superior transaction to you directly.

Our tender offer documents filed with the Securities and Exchange Commission include the complete bid package we submitted to the WBD Board of Directors on December 4. We want you to see firsthand what Paramount proposed and what we, along with our equity and debt financing partners, were prepared to execute on that very day.

Our public offer - identical to the terms we presented to WBD privately - delivers superior value and a faster, more certain path to completion than the transaction announced with Netflix. IT IS NOT TOO LATE TO REALIZE THE BENEFITS OF PARAMOUNT'S PROPOSAL IF YOU CHOOSE TO ACT NOW AND TENDER YOUR SHARES.

Paramount's $30.00 All-Cash Offer for All of WBD Delivers Greater Value Than Netflix

Our offer is financially superior to Netflix's transaction, which provides WBD shareholders with lower value, less cash and significantly less certainty. On its face, Netflix is offering WBD shareholders $23.25 per share in cash, $4.50 in stock and a share in WBD's Global Networks spin-off. In reality, however, the total value is materially lower than advertised:

Netflix's cash component is ~$18 billion lower than Paramount's in the aggregate (~$7 per share).

Netflix's stock price closed at $96.71 on Tuesday and, as of this writing, is trading at $93.81, more than $4 below the low-end of the collar on its stock consideration. This reduces the value of Netflix's offer.

During the pendency of a regulatory review process that could take two years or more, WBD shareholders will be exposed to Netflix stock's downside risk, including technology sector volatility, a lofty ~25x forward EBITDA multiple and the uncertainty of seven future quarterly earnings results. For reference, Netflix has lost approximately one quarter of its market capitalization ($110+ billion) since its last quarterly earnings report and amid its pursuit of WBD.

Buried in an 8-K filing on Friday was a mechanism providing a dollar-for-dollar reduction in the purchase price if more debt gets allocated to Streaming & Studios because of an unspecified cap on Global Networks. While the limit is undisclosed, every $1 billion above it could represent a reduction of ~$0.40 / share.

Netflix's transaction leaves WBD shareholders with 100% of the risk of the Global Networks standalone plan. As outlined on our December 8 investor call, we believe Global Networks is worth ~$1 / share which would mean a total headline value to WBD shareholders in the Netflix deal of $28.75 - below our $30.00 all-cash offer. This is before any risk adjustments described above and any time-value-of-money discounting of Netflix's offer to account for the substantially longer timeline to close (~$1.25 / share for every six months).1 In addition, the Netflix transaction would further exacerbate the decline of Global Networks.

Paramount Has Air Tight Financing to Deliver on its Offer to You

Paramount has lined up all necessary financing to deliver its $30.00 per share all-cash offer to WBD shareholders.

As presented to the WBD Board, Paramount's offer is not subject to any financing conditions and will be financed by $41 billion of new equity backstopped by the Ellison family and RedBird Capital and $54 billion of debt commitments from Bank of America, Citi and Apollo.

On December 3, WBD told us they wanted an Ellison family backstop on our equity financing. We delivered it to them less than 24 hours later. Our December 4 offer included an equity commitment from the Ellison family trust, which contains over $250 billion of assets (more than 6x the equity funding commitment) including approximately 1.16 billion Oracle shares and tens of billions of dollars in other assets. This information is publicly available; and, notably, the trust has been a counterparty in other completed public company transactions including for Twitter, which involved one of WBD's advisors. In fact, the equity commitment papers submitted to WBD were identical in all material respects to commitments that the advisors to WBD had agreed to in other large transactions such as Twitter and Electronic Arts.

To suggest that we are not "good for the money" (or might commit fraud to try to escape our obligations), as certain reports have speculated, is absurd. That absurdity is underscored by the fact that WBD and its advisors never picked up the phone or typed out a responsive text or email to raise any question or concern or to seek any clarification about either the trust or our equity commitment papers.

Our debt commitments are not conditioned upon Paramount's financial condition nor is there any "material adverse change" condition tied to Paramount. The conditions dovetail with our proposed merger agreement, which provided maximum certainty to WBD and its shareholders.

Netflix Faces Severe Regulatory Uncertainty & Closing Risk - Paramount Does Not

Paramount's offer not only delivers superior value and certainty, but also a much shorter and more certain path to completion. To underscore our confidence, we have already filed for Hart-Scott-Rodino (HSR) approval in the United States and announced the case to the European Commission, opening the path to pre-notification discussions. We look forward to working collaboratively with the relevant authorities to work through the review process and deliver this transaction to you and our other stakeholders.

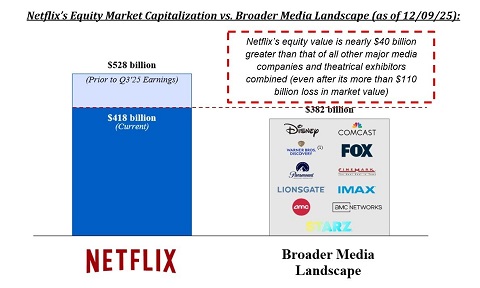

WBD's transaction with Netflix, on the other hand, appears to be in for a long and bumpy ride as it navigates the global regulatory review process. Netflix is the #1 streaming business globally by subscriber count and HBO Max is #4. Combining these two yields an overwhelming market share of ~43% - more than 2x the #2. This is in addition to the other serious competition concerns raised, including from vertically integrating WBD's film and TV production studios into Netflix, which will give Netflix greater leverage over theatrical exhibitors and creative talent alike. Notably, and as an indicator of its global dominance, Netflix's current equity market capitalization dwarfs that of all other major media companies and theatrical exhibitors combined (even after the above-mentioned $110+ billion loss in value):

Outside the United States, Netflix's regulatory path is particularly challenged in Europe where its dominance is far more entrenched. Our analysis was conducted by the former deputies of merger enforcements for the European Commission and the U.K.'s Competition and Markets Authority. Netflix is by far the dominant streaming service in Europe, accounting for 51% of the total European OTT subscription revenue in 2024, with Disney a distant second at only 10%. The acquisition of WBD's Streaming & Studios business is a blatant attempt to eliminate one of Netflix's only viable international competitors in HBO Max. Market share analysis aside, Netflix also needs to satisfy Europe's new landmark Digital Services Act and Digital Markets Act created for a situation precisely like this - protecting consumers from Big Tech overreach.

The argument being advanced publicly by Netflix and its proxies states that regulators should ignore the SVOD market and instead utilize a gerrymandered market definition that includes services like YouTube, TikTok, Instagram, and Facebook. Netflix's claim boils down to trying to mask its dominance in SVOD by grouping together all internet-enabled video, media, social media, or otherwise. No regulator has ever accepted such a broad approach to market definition, and to do so would require regulators to give up on merger enforcement in media and social media alike.

It is noteworthy that, unlike Paramount's willingness to agree to remedies up to a "material adverse effect" on the combined company, Netflix's regulatory remedy commitments expressly state no remedy whatsoever can be imposed on Netflix's business. Netflix also has a longer timeline - an "outside date" of 21 months. Paramount backed up its commitments with a $5 billion regulatory reverse termination fee. Netflix's incremental $800 million over that amount does not close the gap between the differences in regulatory complexity and challenges.

For the avoidance of doubt, our $6 billion synergy estimate does not rely on cuts to content budgets at our studios and we intend to continue running both separately post-close. Our synergy analysis relies on efficiencies elsewhere across the combined organization, including technology, linear networks optimization, and real estate rationalization. Having experienced what it is like to act in and produce films first-hand, I have profound respect for creative talent. This is why we are fully pro-Hollywood, dedicated to supporting a growing theatrical slate of over 30 films per year and investing in the people and storytelling that drive the industry forward.

WBD's Murky Sale Process

Over the last few days, we have heard from WBD shareholders and other stakeholders all asking the same question - what happened? Frankly, we are asking the same question.

The WBD sale "process" was unusual in that, over the entire period, its advisors never delivered to Paramount a single markup of any of our transaction documents - not our merger agreement nor our equity commitment documents. In addition, there was not a single "real time" negotiating session with us.

When Paramount submitted its fifth proposal on December 1, a proposal accompanied by full transaction documents that we stated we were prepared to sign, we offered $26.50 / share in cash.

On December 3, WBD provided feedback on Paramount's proposal and communicated that the WBD Board would be "meeting periodically over the course of this week" but they never asked for a re-bid (which is strange if your goal is to maximize value for shareholders). On that call, our advisors asked whether the WBD Board continued to prioritize cash consideration as they had consistently communicated to us. WBD's lead advisor's response: "Isn't cash always king?" One must ask: was that same message being delivered to Netflix?

Despite the opaque process, Paramount proactively submitted a revised offer with full transaction documentation in under 24 hours (at 11:00 am ET on December 4) and stated that Paramount and our funding sources were ready to sign it immediately. This revised offer addressed all of the scarce feedback that Paramount received.

Yet on that final pivotal day when WBD's fate hung in the balance, we received not a single call, text or email to clarify anything about Paramount's $30 per share all cash offer. Instead, and while in possession of our superior and fully committed bid and documents that entire day, the WBD Board and its advisors sprinted toward a deal with Netflix (even ignoring two separate texts from myself and Paramount's advisors stating that we had never said "best and final").

WBD Shareholders Have the Power to Get WBD on the Right Path

Our proposal represents a compelling opportunity for WBD shareholders. We are committed to seeing this transaction through.

Since Monday, we have had the opportunity to speak with a number of WBD shareholders who have expressed confusion and disappointment at the process that WBD conducted, which appears to have prioritized a deal with Netflix over shareholder value maximization. Multiple equity research notes published over the last 48 hours have also agreed that our offer is superior and that the Global Networks spin-off does not close the gap to $30.00 in cash.

From here, you can expect WBD to respond to our tender offer within 10 business days via a 14D-9 filing with the SEC. Our tender offer will remain open for at least 20 business days. The closing of the tender offer is conditioned upon, among other things, a majority of WBD shares tendering in our favor, receipt of regulatory approvals, termination of the Netflix merger agreement and entry into a definitive merger agreement with us.

WE URGE YOU TO REGISTER YOUR VIEW WITH THE WBD BOARD THAT YOU DEEM PARAMOUNT'S OFFER TO BE SUPERIOR BY TENDERING YOUR SHARES TODAY.

Sincerely,

David Ellison

Chairman and Chief Executive Officer

Paramount Skydance Corporation

Tender Offer Process FAQs

The below frequently asked questions provide a summary of relevant information for shareholders looking to understand more about Paramount's tender offer. Full details of the tender offer can be found here.

Why should I tender my shares?

Paramount has launched an all-cash tender offer to acquire all outstanding shares of Warner Bros. Discovery ("WBD") for $30.00 per share. We believe our offer provides superior value through a simple all-cash structure and a quicker, clearer path to completion than the transaction that WBD agreed to with Netflix. It is not too late to get the benefits of Paramount's offer if you act now. By tendering your shares, you are registering your view with the WBD Board of Directors that Paramount's offer is superior to the Netflix transaction.

How do I tender my shares?

If you are the record holder of your shares:

Mail the following to Equiniti Trust Company, LLC, which is acting as depositary in the offer, at one of the addresses specified in the Letter of Transmittal:

the certificates representing your shares;

completed Letter of Transmittal; and

any other documents required by the Letter of Transmittal.

The mailing must occur by 5:00 p.m., New York City time, on January 8, 2026 (unless further extended by Paramount).

If you hold your shares in street name (i.e., through a broker, dealer, commercial bank, trust company or other nominee (a "Broker")):

Request that your Broker effect the transaction for you.

Each such Broker will detail the process in its communication to you about the offer.

Contact Okapi Partners LLC ("Okapi"), our information agent, at the number or email set forth below for assistance with tendering your shares or with any other specific questions about the offer.

For detailed instructions on procedures for tendering your shares, please see the section of the Offer to Purchase entitled "The Offer-Section 3-Procedure for Tendering Shares," which can be accessed here. A form of the Letter of Transmittal is filed as an exhibit to the Schedule TO-T filed by Paramount with the SEC, which form can be accessed here.

When should I tender my shares?

The sooner you tender your shares the better. The tender offer is scheduled to expire at 5:00 p.m., New York City time, on January 8, 2026, which date may be extended by Paramount.

Can I withdraw my tender if I change my mind?

Yes. You may withdraw your previously tendered shares at any time before the expiration date. Generally, following the expiration, all tendered shares are irrevocable. However, if Paramount has not accepted the shares tendered for payment pursuant to the offer by February 9, 2026 (the first business day after the 60th day following commencement of the tender offer), you may also withdraw your previously tendered shares after such date (i.e., on or after February 10, 2026). For additional information on the limitations to and procedures for withdrawing your shares, please see the section of the Offer to Purchase entitled "The Offer-Section 4-Withdrawal Rights," which can be accessed here.

Who should I call with questions about tendering my shares?

You may direct questions and requests for assistance to Okapi. Banks and brokerage firms can call (212) 297-0720, and shareholders and all others can call toll-free (844) 343-2621. They can also be reached via email at info@okapipartners.com.

Other Questions We Have Heard From WBD Shareholders

What is the Lawrence J. Ellison Revocable Trust u/a/d 1/22/88 (the "Trust")?

Larry Ellison's Trust holds substantially all of Mr. Ellison's assets, including 1.158 billion shares of Oracle Corporation (approximate value on 12/9/25 of $257 billion).

The Trust was formed in 1988 and, along with its many wholly owned subsidiaries, has engaged in many thousands of transactions since that time, with no intention to change the way it does business.

The Trust has participated in multiple large-scale transactions and has been vetted by public companies and most of the largest banks in the US.

By way of example, the Trust backstopped a multi-billion-dollar equity investment to fund Skydance's acquisition of Paramount and funded a $1 billion investment in Twitter's take-private (which was advised by Wachtell, Lipton, Rosen & Katz, WBD's legal counsel).

The Trust has direct banking relationships with each of the four largest US banks and six of the top ten US banks (as measured by total assets).

Any concern that the Trust would take any steps to avoid its obligations (i.e., commit fraud) is meritless and, if such a concern is ever directly raised with the Trust, we will happily address it in the paperwork.

Did the Trust submit an equity backstop in support of Paramount's bid for WBD?

Yes, the Trust submitted an equity backstop for $40.4 billion dollars.

The paperwork submitted in the bid for WBD represents a completely customary and enforceable equity financing commitment and is identical in all material respects to the equity financing terms in the Paramount/Skydance transaction and other large leveraged buyouts (e.g., Twitter).

However, to the extent that WBD raises legitimate concerns about the terms of the equity financing, the Trust will happily address such concerns in the transaction documentation.

Should Global Networks trade in line with Versant (Comcast's pending spinoff)?

Versant is not yet a public company. Regular way trading will begin on January 5, 2026. At the moment, equity research analysts estimate that it will trade at ~4-5x NTM EBITDA.

We believe Global Networks is worth ~$1 / share, which is based on a 4.5x EV / next twelve months EBITDA for the business as of Q3'26 (when WBD expects to close its separation).

While we believe Versant is a good comp for Global Networks, Global Networks should trade at a material discount to Versant given:

Versant will be significantly less leveraged (~1.25x net leverage for Versant vs. >3x for Global Networks)

Versant's live news and sports portfolio, which we believe is the highest value category in Pay TV, far outpaces Global Networks:

Live news and sports account for ~62% of Versant's audience vs ~20% for WBD.

Compared to Global Networks' CNN and Turner networks (which essentially lost all sports rights following the loss of NBA rights), Versant owns a robust portfolio of some of the most valuable live news and sports channels including CNBC, MS Now (formerly MSNBC), the Golf Channel and USA. Its live sports rights are contracted until ~2028-2036 and include the English Premier League, the Olympics, the WNBA, WWE, the PGA Tour and NASCAR, among others.

A large portion of Versant's business is in digital, higher growth assets (e.g., GolfNow, Rotten Tomatoes and Fandango), whereas Global Networks' only major digital asset is Bleacher Report.

Versant is much less weighted toward lower value lifestyle and reality content that Global Networks specializes in (e.g., HGTV, Food Network, TLC, Discovery Channels).

What is included in the $6 billion+ run-rate cost synergy target?

We are very focused on maintaining the creative engines of the combined company,

Our synergies estimate is driven by duplicative operations across all aspects of the business - specifically, back office, finance, corporate, legal, technology, infrastructure and real estate.

Our content savings estimate reflects only a <10% reduction of combined spend, none of which is derived from film/TV studios. As we have mentioned several times, we do not plan to reduce theatrical output - we intend to grow our slate to over 30 films each year. Instead, we expect to make smarter decisions about licensing across linear networks and streaming.

On a combined basis, we still expect to lead the industry in content spending (~$35 billion annually vs. Netflix's publicly announced expectation of ~$18 billion for 2025).

It is important to note that context matters. Because it is only buying part of WBD, Netflix's $2-3 billion announced synergy target in its transaction does not include any savings from Global Networks - WBD's largest segment by SG&A in 2024 ($2.8 billion, vs. $2.4 billion in Studios and $2.2 billion in Streaming). The suggestion that Paramount's plan relies on deeper job cuts than Netflix's is not supported by any facts.

WBD shareholders and other interested parties can find additional information about Paramount's superior offer at www.StrongerHollywood.com.

About Paramount, a Skydance Corporation

Paramount, a Skydance Corporation (NASDAQ: PSKY) is a leading, next‑generation global media and entertainment company, comprised of three business segments: Filmed Entertainment, Direct-to-Consumer, and TV Media. Paramount's portfolio unites legendary brands, including Paramount Pictures, Paramount Television, CBS - America's most-watched broadcast network, CBS News, CBS Sports, Nickelodeon, MTV, BET, Comedy Central, Showtime, Paramount+, Paramount TV, and Skydance's Animation, Film, Television, Interactive/Games, and Sports divisions. For more information, please visit https://www.paramount.com/.

Cautionary Note Regarding Forward-Looking Statements

This communication contains both historical and forward-looking statements, including statements related to Paramount's future financial results and performance, potential achievements, anticipated reporting segments and industry changes and developments. All statements that are not statements of historical fact are, or may be deemed to be, "forward-looking statements". Similarly, statements that describe Paramount's objectives, plans or goals are or may be forward-looking statements. These forward-looking statements reflect Paramount's current expectations concerning future results and events; generally can be identified by the use of statements that include phrases such as "believe," "expect," "anticipate," "intend," "plan," "foresee," "likely," "will," "may," "could," "estimate" or other similar words or phrases; and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause Paramount's actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements. These risks, uncertainties and other factors include, among others: the outcome of the tender offer by Paramount and Prince Sub Inc. (the "Tender Offer") to purchase for cash all of the outstanding Series A common stock of WBD or any discussions between Paramount and WBD with respect to a possible transaction (including, without limitation, by means of the Tender Offer, the "Potential Transaction"), including the possibility that the Tender Offer will not be successful, that the parties will not agree to pursue a business combination transaction or that the terms of any such transaction will be materially different from those described herein, the conditions to the completion of the Potential Transaction or the previously announced transaction between WBD and Netflix Inc. ("Netflix") pursuant to the Agreement and Plan of Merger, dated December 4, 2025, among Netflix, Nightingale Sub, Inc., WBD and New Topco 25, Inc. (the "Proposed Netflix Transaction"), including the receipt of any required stockholder and regulatory approvals for either transaction, the proposed financing for the Potential Transaction, the indebtedness Paramount expects to incur in connection with the Potential Transaction and the total indebtedness of the combined companies, the possibility that Paramount may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate the operations of WBD with those of Paramount, and the possibility that such integration may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the Potential Transaction; risks related to Paramount's streaming business; the adverse impact on Paramount's advertising revenues as a result of changes in consumer behavior, advertising market conditions and deficiencies in audience measurement; risks related to operating in highly competitive and dynamic industries, including cost increases; the unpredictable nature of consumer behavior, as well as evolving technologies and distribution models; risks related to Paramount's decisions to make investments in new businesses, products, services and technologies, and the evolution of Paramount's business strategy; the potential for loss of carriage or other reduction in or the impact of negotiations for the distribution of Paramount's content; damage to Paramount's reputation or brands; losses due to asset impairment charges for goodwill, intangible assets, FCC licenses and content; liabilities related to discontinued operations and former businesses; increasing scrutiny of, and evolving expectations for, sustainability initiatives; evolving business continuity, cybersecurity, privacy and data protection and similar risks; content infringement; domestic and global political, economic and regulatory factors affecting Paramount's businesses generally, including tariffs and other changes in trade policies; the inability to hire or retain key employees or secure creative talent; disruptions to Paramount's operations as a result of labor disputes; the risks and costs associated with the integration of, and Paramount's ability to integrate, the businesses of Paramount Global and Skydance Media, LLC successfully and to achieve anticipated synergies; volatility in the prices of Paramount's Class B Common Stock; potential conflicts of interest arising from Paramount's ownership structure with a controlling stockholder; and other factors described in Paramount's news releases and filings with the Securities and Exchange Commission (the "SEC"), including but not limited to Paramount's most recent Annual Report on Form 10-K and Paramount's reports on Form 10-Q and Form 8-K. There may be additional risks, uncertainties and factors that Paramount does not currently view as material or that are not necessarily known. The forward-looking statements included in this communication are made only as of the date of this report, and Paramount does not undertake any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances.

Additional Information

This communication does not constitute an offer to buy or a solicitation of an offer to sell securities. This communication relates to a proposal that Paramount has made for an acquisition of WBD and the Tender Offer that Paramount, through Prince Sub Inc., its wholly owned subsidiary, has made to WBD stockholders. The Tender Offer is being made pursuant to a tender offer statement on Schedule TO (including the offer to purchase, the letter of transmittal and other related offer documents), filed with the SEC on December 8, 2025. These materials, as may be amended from time to time, contain important information, including the terms and conditions of the offer. Subject to future developments, Paramount (and, if a negotiated transaction is agreed, WBD) may file additional documents with the SEC. This communication is not a substitute for any proxy statement, tender offer statement, or other document Paramount and/or WBD may file with the SEC in connection with the proposed transaction.

Investors and security holders of WBD are urged to read the tender offer statement(s) (including the offer to purchase, the letter of transmittal and other related offer documents), and any other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of WBD. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Paramount through the website maintained by the SEC at http://www.sec.gov.

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Paramount and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies against the Proposed Netflix Transaction. You can find information about Paramount's executive officers and directors in Paramount's Current Reports on Form 8-K filed with the SEC on August 7, 2025, and September 16, 2025, and Paramount's Quarterly Report on Form 10-Q filed with the SEC on November 10, 2025. Additional information regarding the interests of such potential participants will be included in one or more proxy statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC's website at http://www.sec.gov.

|